Exclusive benefits of the BMG Card

With the BMG Card, every purchase becomes an opportunity to save.

Part of the value of your transactions is returned in the form of cashback.

Allowing you to accumulate a positive balance for future expenses or invoice deductions.

Security is a key word when it comes to credit cards.

THE BMG Card offers chip and password technology, in addition to advanced monitoring systems to prevent fraud, ensuring complete peace of mind in your financial operations.

THE BMG Card offers a fast and efficient customer service, 24 hours a day, 7 days a week, ensuring that your issues are resolved quickly and without complications.

Manage your BMG Card has never been easier. With the app BMG Card, control your expenses, view your invoice and have access to exclusive features in the palm of your hand.

A practical and modern way to stay up to date with your financial life.

In addition to the economic advantages, being a carrier of the BMG Card, you gain access to a universe of discounts and special partnerships.

These are offers on stores, services, and even entertainment, extending the benefits of your card beyond your personal finances.

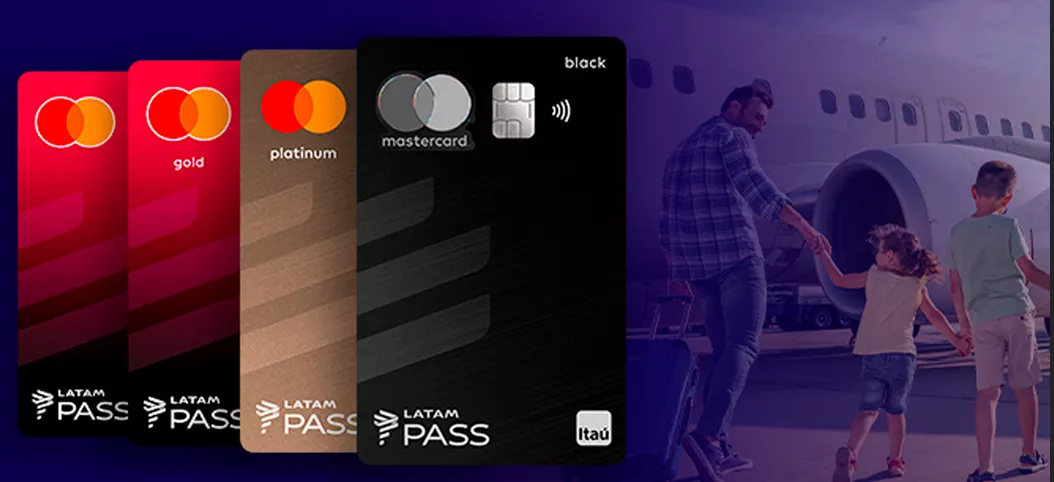

THE BMG Card is part of the program Mastercard Surprise, which offers points on every purchase that can be exchanged for rewards or even unique experiences, doubling the satisfaction of every choice you make.

You don't need to face bureaucracy to get yours BMG Card. The process is done fully online, fast and straightforward, allowing more people to enjoy the benefits offered.

By being part of the BMG family, each client is treated exclusively, receiving a set of advantages that make the BMG Card a powerful tool for everyday life.

Explore all the possibilities and be part of this unique financial experience!

Basic Requirements for Request

Before you begin the application process online of your BMG Card, make sure you meet the basic requirements.

You must be over 18 years old, have an active CPF and have an up-to-date proof of residence.

Additionally, it is important to have your personal documents on hand to fill in the necessary data.

Access the BMG Website or App

Start the process by visiting the official BMG website or downloading the app. My BMG, available for both Android as for iOS.

However, both methods offer a secure and intuitive platform for you to make your request comfortably from anywhere.

Create an account: First, create an account by providing your email address and a secure password.

Request form: Fill out the form with your personal, professional, and financial information. Make sure all information is correct to avoid delays in approval.

Sending documents: Take clear, legible photos of your documents and upload them through the website or app. This step is crucial to validate your information and ensure the security of the process.

Wait for analysis: After submitting your application, BMG will perform a credit analysis which may take a few business days.

Request Tracking

You can track the status of your request directly through My BMG app or through the website. You'll receive notifications about each step of the process, from analysis to approval and card dispatch.

Card Activation

For example, After receiving your BMG Card, access the website or application again to activate.

In other words, follow the instructions provided to unlock your card and start enjoying the benefits and services available.

Questions and Support

Furthermore, in case of doubts or need for support during the process, BMG offers customer service through various channels.

For example, you can contact us by phone, in-app chat, or online support on the website.

First of all, it is important to understand what annuity is. Annuity is a rate that some financial institutions charge credit card users for the service offered.

Still, The BMG Card stands out for not charging an annual fee. This is part of the policy of transparent and fair relationship that Banco BMG maintains with its customers.

In this sense, the annual fee waiver represents a significant saving, leaving more money in your pocket.

However, to continue taking advantage of the annual fee exemption, is necessary to meet some criteria, such as frequent use of the card and subscription to the bank's digital services.

In addition to savings on the annual fee, the exemption brings other benefits. Customers with BMG Card may have access to promotions and exclusive discounts, further increasing your financial advantage.

Furthermore, to put it simply, the BMG Card annual fee exemption is an opportunity to economy, especially benefiting those who use it regularly.

In other words, BMG's strategy is to build a relationship of trust and value for its customers, favoring the continued use of the card and bank services.