If you are just starting out in your financial life, have a low credit score or want an easy-to-approve card, there are several options on the market with more accessible criteria. These cards can be a gateway to building or recovering your financial history.

Check out a selection of the easiest credit cards to approve in 2025 and see which one best fits your profile.

This card has no annual fee and is approved even for those with an intermediate credit score. Ideal for those seeking convenience and benefits for everyday use.

Available to non-account holders, with an annual fee waived upon spending a minimum monthly amount. Easy approval and Visa card.

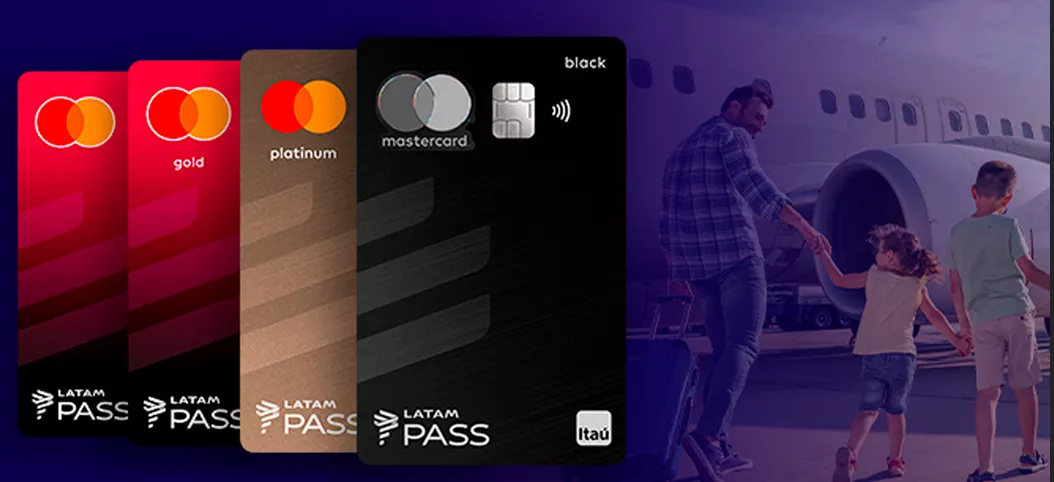

Entry-level card from Itaú Bank, with a competitive initial limit and benefits commensurate with the category. The analysis is flexible for profiles with bank transactions.

No-annual-fee card linked to your Neon digital account. Full control via the app and cashback available on certain purchases.

Offers 1 Inter Loop loyalty point for every R$ 10 spent. Processing is usually quick, and the card has no annual fee.

No minimum income requirement and cashback on purchases made through PicPay Shop. It has a good approval rate.

Renowned for its ease of application and fully digital management. Credit analysis is dynamic, and many users start with a basic limit.

Card with adjustable initial limit, no annual fee, and progressive benefits based on use. Easy approval via app.

Prepaid card, ideal for those with a negative credit score or very low credit score. No credit check required.

Offers automatic cashback and no annual fee, with a modern design and comprehensive app. A good option for those new to credit.

Digital card with no annual fee, partner discounts, and easy app control. Flexible analysis is available for new customers.

The ideal card for those who shop at Magazine Luiza. It offers 2% cashback on in-store purchases and waived annual fees with recurring use.

Card with no annual fee, intuitive app, and rewards program. Approval is usually quick and straightforward.

Visa Gold card with benefits within the Mercado Livre ecosystem. Offers extended installment plans and simplified release.

Card with no annual fee and no income requirement. Easy approval for those starting out or rebuilding their credit.

Ideal for retail purchases of the brand, with discounts and special conditions. Approval is usually quick for those who buy in stores.

The ideal card for purchases at Assaí Atacadista. Customers pay wholesale prices for just one unit or more.

Offers discounts and easy installment plans on purchases at Atacadão stores. Simple approval and a card designed for retail use.

Prepaid card that doesn't require a credit check. Ideal for those who want full control over their spending with cashback on all purchases.

Conclusion

Choosing a credit card that's easy to approve can be the first step toward building a healthy financial life. Analyze your profile, check each issuer's requirements, and choose the option that offers convenience, control, and real benefits for your daily life.