When unexpected expenses arise, being aware of the different quick credit options can be an immediate relief.

From online personal loans to salary advances, each option has its own unique features.

Personal loans are a convenient way to access funds quickly.

They usually have a fast approval process and can be requested through applications or websites specialized in credit.

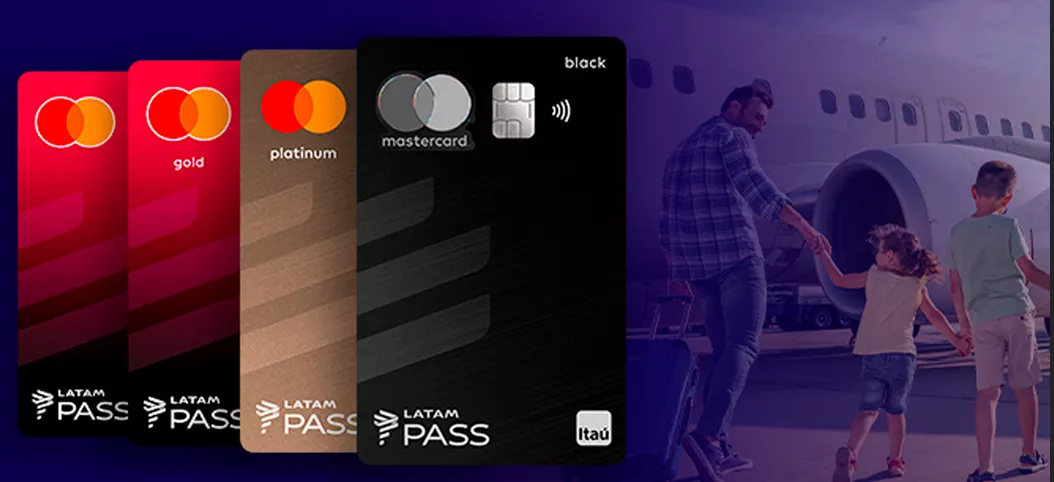

Credit cards that offer instant approval can be a ready-to-use line of credit. They allow for emergency purchases and, in some cases, cash withdrawals.

A personal line of credit works like a revolving credit limit, where you use only what you need and pay interest only on the amount used.

Some employers or paycheck advance services allow you to access a portion of your paycheck earlier than usual, making it an option for immediate emergencies.

Important Considerations When Choosing Fast Credit

Deciding on the best fast credit option requires attention to detail and understanding the conditions. By making an informed choice, you can meet your emergency needs efficiently and safely.

Understand Your Financial Requirements: Before seeking quick credit, it is essential to be clear about the amount needed and the time frame in which you can repay the loan.

This clarity helps you avoid unnecessary debt and choose the best credit option for your situation.

Compare Available Options: Use online tools to compare interest rates, repayment terms, and conditions offered by different lenders.

This can be easily done through credit comparison sites or by visiting financial institutions' websites.

Check the Lender's Reputation: Research the reputation of financial platforms or institutions. Check other users' reviews and see if the lender has the necessary authorizations to operate, ensuring a safe choice.

Organize the Necessary Documentation: Although it is a credit without bureaucracy, some basic documents are generally requested.

Prepare your ID, CPF, proof of residence, and proof of income, which can speed up the loan approval process.

Choose Online Options: Online credit platforms often offer faster, less bureaucratic processes. Some don't even require physical documentation; everything is done digitally.

Pay Attention to the Terms of the Contract: Read all loan terms and conditions carefully to avoid surprises with extra fees or clauses that were unclear at first, ensuring you make an informed choice.

Loan Simulation: Use the simulation tools available on the institutions' websites to get an accurate idea of the installment amount, the interest rate applied, and the total cost of the loan.

Confirm Deposit Time: After approval, make sure the institution has an efficient deposit system, ensuring the amount will be available in your bank account within the timeframe you need.

Just as financial need knocks at the door, every second counts.

Opt for one fast credit It's like pressing the turbo button on your finances, providing an almost immediate solution to any unexpected situation.

However, bureaucracy can be a significant obstacle, especially when you're in a rush. With fast credit, you say goodbye to the mountain of paperwork and simplify the application process.

Still, This means less stress and a smoother path to your financial peace of mind.

However, whatever the reason for your financial hardship—an unexpected medical bill, an urgent car repair, or any other emergency—fast credit adapts to your situation.

However, with versatility as one of its greatest benefits, it adapts to your specific needs.

However, relief in cash flow is palpable when you opt for fast credit services.

In other words, with financial resources available in record time, it is possible to balance accounts and maintain financial health without compromising other obligations.

Still, by choosing the quick credit option, you not only resolve the immediate issue but also create a precedent for solving future challenges.

In that sense, it's like having a umbrella financial always available!

In other words, when finalizing your choice of fast credit, remember to use reliable and regulated platforms to ensure your security and financial well-being.

Explore options like the app Nubank, the fintech Neon, and the online credit service Credicard.

However, each of these offers different types of quick credit and can be easily accessed via websites or apps.

Nubank – Practical credit solutions.

Neon – Fast credit without bureaucracy.

Credicard – Online loan with fast response.