How to choose the best credit card with no annual fee

Understand Your Consumption Profile

Before choosing a credit card with no annual fee, it is important understand your consumption profile.

Analyze your monthly spending and purchasing habits to select a card that meets your needs without additional costs.

Check out the points and rewards programs offered.

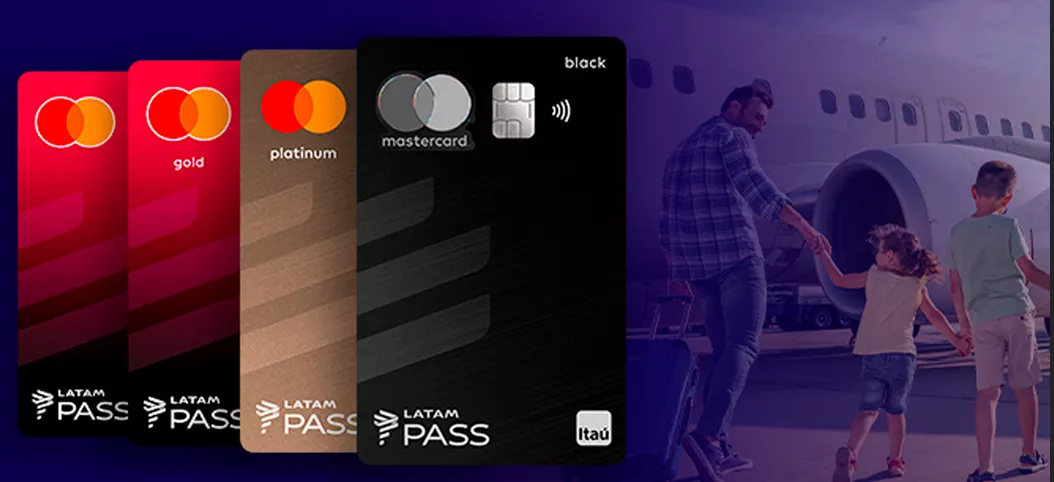

Some cards with no annual fee still offer benefits that can be advantageous, such as cashback, airline miles, and discounts with partners.

Make sure the credit card you choose is widely accepted at the establishments you frequent. Cards with well-known brands tend to have a better market acceptance.

The credit limit is a crucial aspect to consider. Make sure the card offers a limit compatible with your expenses regularly to avoid inconveniences during shopping.

Although they have no annual fee, some cards may have other fees or higher interest rates in revolving credit operations or withdrawals.

Pay attention to these details before making your decision.

Credit cards that offer online management applications and resources facilitate monitoring of expenses and financial control.

Give preference to institutions that invest in technology to provide a better user experience.

Consulting other users' reviews and experiences can provide valuable insights into the card. Look for criticism and recommendations on forums, social networks and websites specializing in finance.

Taking these factors into consideration, you will feel more secure about choose the no-annual-fee credit card that best suits your lifestyle.

Using a no-annual-fee credit card can simplify your financial life in many ways. Below, we highlight: practical benefits that you can enjoy in your daily life.

THE most obvious point and attractive thing about credit cards with no annual fee is the savings generated by exemption from this fee.

Instead of paying hundreds of reais every year, this money can be allocated to investments or used for daily needs.

With a credit card with no annual fees, it's easier to manage your finances and avoid unnecessary expenses. This translates into greater freedom to plan and prioritize your spending.

The possibility of paying for purchases in installments without accumulating annual fees increases your purchasing powerThis allows you to plan larger purchases and improve monthly budget management.

Cards with no annual fee usually have applications or online interfaces that facilitate expense control.

With features like payment reminders and purchase categorization, keeping your finances organized becomes easier.

In this sense, many cards with no annual fee offer points programs and cashback.

These can be used to exchange for products, services, or even a discount on your bill, maximizing the benefits of each purchase made.

Furthermore, credit card holders can have access to exclusive promotions and discounts in partner stores.

For example, this includes everything from airline tickets to electronics and clothing, which can represent huge savings throughout the year.

However, modern credit cards, including those with no annual fee, often offer a variety of security layers, such as app locks, SMS for each transaction and anti-fraud chips.

In other words, this brings extra peace of mind in daily use.

Additionally, using and paying your credit card bill on time helps build a good credit history.

Furthermore, this can be beneficial for obtaining financing, loans or approval for cards with more benefits in the future.

However, with so many options available on the market, it can be difficult to choose the credit card with no annual fee that best suits your needs.

To help you make this choice, we've prepared a comparison that highlights the most relevant features of popular cards, ensuring you make an informed choice.

In other words, One of the pioneers among the digital cards with no annual fee, Nubank stands out for its ease of management through the app and its highly rated customer service.

For example, Banco Inter offers a card with no annual fee that accompanies the bank's digital account, integrating services and reducing the need for multiple platforms.

In this sense, with a focus on young and dynamic customers, C6 Bank offers a credit card with no annual fee that allows for customization and distinct services.

Furthermore, Digio presents itself as an option with no annual fees and without the complexity of points or cashback programs, ideal for those looking for simplicity.

However, choosing a credit card with no annual fee should be based on your financial situation, spending habits and personal preferences.

In other words, remember to consider factors such as fees, additional benefits, and the card issuer's reputation. Study each option and determine which one offers the best value for your lifestyle.

Useful Links: